27 December 2023

Insight into the banking moves carried out by the House Rothschild and red China.

Quotes :

The thesis focuses on banking, finance and other interactions between the Rothschild dynasty and various actors from the People’s Republic of China. The potential discrep- ancy between capitalist and communist ideology is observed through the rational choice theory. The research has shown that many interactions have been unique and ground-breaking for both sides, and these activities visibly strengthened the PRC’s in- ternational competitiveness. In addition, the public narrative about the Rothschilds in the PRC is largely shaped by information that is rejected in the West as conspiracy the- ories.

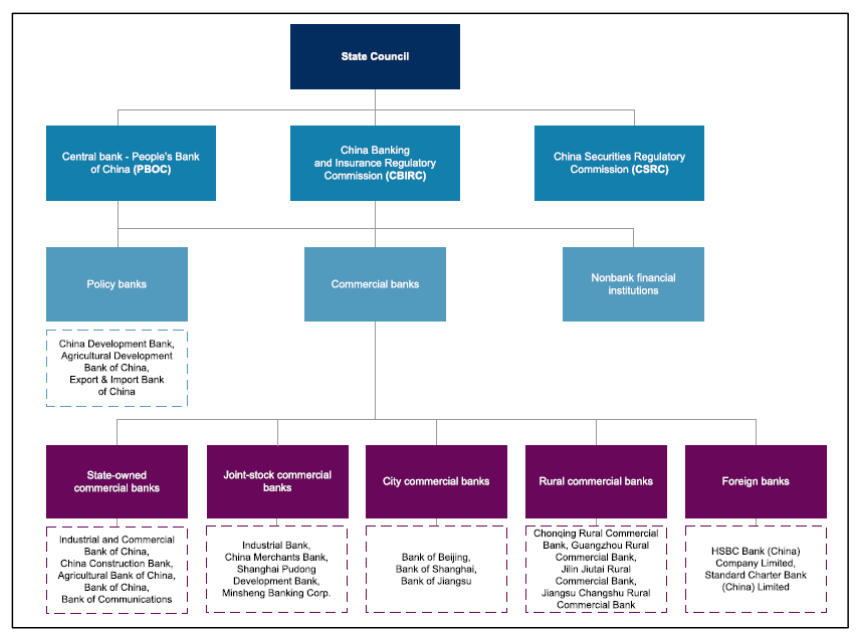

On the other side is the People’s Republic of China, since its founding in 1949 run by the Chinese Communist Party (CCP). The constitution states following: “The People’s Republic of China is a socialist state governed by a people’s democratic dictatorship that is led by the working class and based on an alliance of workers and peasants.

The socialist system is the fundamental system of the People’s Republic of China. Leadership by the Communist Party of China is the defining feature of socialism with Chinese characteristics. It is prohibited for any organization or individual to damage the socialist system.” (The National People’s Congress, 2007) In reality, the CCP de facto acts as a single-party government in charge of various functions of the state. Its economic system is based on the Marxist ideology, which have historically stressed the importance of class struggle through the act of taking the power from the exploiting bourgeois group and giving it back to the common people. In this regard, the constitution’s preamble states that in 1949, under the leadership of Mao Zedong and the CCP, the Chinese people “overthrew the rule of imperialism, feudalism and bureaucrat-capitalism, won a great victory in the New Democratic Revolution, and founded the People’s Republic of China. The Chinese people thus secured power and became masters of their own country.” (The National People’s Congress, 2007)

After the PRC was founded on 1 October 1949 by the CCP’s leader Mao Zedong, a new sociopolitical system that stressed the class struggle and the fight against bourgeois emerged in China. At the same time, Guomindang nationalist government led by Chiang Kai-shek moved to Taiwan, where the de facto independent Republic of China exists ever since.

Timeframe of the wider research follows roughly seven decades of the PRC’s existence between 1949 and the present moment (2021). This choice allows to map and analyse the development under different Chinese leaders and the changing circumstances of the two sides’ interactions. Previous relations which date back to the 1830s are also briefly mentioned, as they offer valuable insight into the roots from which subsequent dealings have stemmed. The work thus conveys a certain idea of Rothschilds relations with China during the Qing dynasty and right after its fall. For a period from around the 1920s until the establishment of the PRC, direct interactions between the Rothschilds and the Chinese entities are not documented, with a few exceptions.

When Rothschilds conducted their first cooperation with the Middle Kingdom in 1838, it was under the reign of Daoguang (道光), the 7th Emperor of the Qing Dynasty. After suffering the defeat from Western powers in the Opium Wars, China had to open various treaty ports along its coast for international trade, with foreigners operating under the extraterritorial law. (Suzuki, 2021) This event brought fundamental and long-lasting changes to the Chinese monetary and banking system, coming from the simultaneous establishment of Western merchant houses and later banks that engaged in money exchange and trade finance. Those banks, coming from the West as well as Japan, began to accept deposits and issue bank notes convertible into silver. Signing of the Sino-Japanese treaty of Shimonoseki in 1896 expanded the scope of foreign direct investment and further strengthened the political control of foreign business interest at the expense of China’s central authority.

According to Ferguson, probably the most important Rothschild agent in the 1830s was Daniel Weisweiller, who had been sent to Madrid. It was in Spain where in 1835 Rothschilds acquired Almadén company, specialising in quicksilver production and gold refinement. This enterprise was extremely significant in upcoming decades, because in 1852, the London House was granted a lease on the Royal Mint Refinery and basically created a monopoly in gold bullion production. Gold as a raw material was an object of interest in the Californian gold rush, where Rothschilds seized the opportunity and placed several of their agents. Furthermore, between 1834 and 1843, N M Rothschild acted as Banker to the US Government in Europe.

In 1887, Aline Caroline de Rothschild, the granddaughter of Jacob (James) Mayer Rothschild, marries Edward Albert Sassoon. (Sotheby’s, 2020) The Sassoon’s, originally Baghdadi Jews, we’re also called “the Rothschilds of the East“. The reason behind this is understood when we take into consideration the scope of their business in the Orient. The house of David Sassoon & Co., had branches at Calcutta, Shanghai, Canton, and Hong kong; and his business, which included a monopoly of the opium-trade, extended as far as Yokohama, Nagasaki, and other cities in Japan. Sassoon attributed his great success to the employment of his sons as his agents and to his strict observance of the law of tithe.“ (Jewish Encyclopedia, n.d.-b)

In 1937, China faced the full-scale invasion from Japan, followed by a massive civil War and the hyper-inflation of the late 1940s. This brought an end to the Nationalist rule and a victorious Communist government emerged to create a command economy that eliminated both private markets and money. (Ma, 2012)

In 1961, Victor, 3rd Lord Rothschild7 (1910-1990) began work for Shell Research Ltd., of which he was chairman from 1963 until his retirement in 1970. From 1971 to 1974, he was the first Director-General of the Central Policy Review Staff (or simply “think tank”) in the United Kingdom. From 1975 to 1976, Victor chaired N M Rothschild and Sons Limited and remained active in the firm until he died in 1990. The main family business was driven by Sir Evelyn de Rothschild, who first became a Partner in N M Rothschild & Sons in 1959 and a Chairman in 1976. Besides that, he chaired the Rothschilds Continuation Holdings AG, which acted as a coordinating company for the merchant banking group. (The Rothschild Archive, n.d.-a)

In 1996, N M Rothschild; Sons Limited formed an equity capital markets joint venture with ABN AMRO, naming the new venture ABN AMRO Rothschild. The family archive elucidates on this: “The joint venture combined Rothschilds’ extensive capital markets advisory experience with ABN AMRO’s global, research, distribution and trading capabilities to provide a full advisory and execution service to governments and corporations worldwide in the field of privatisation, international equity offerings, equity capital raisings and private placements.” (The Rothschild Archive, n.d.-a) The family further commented on their role in privatisation in an archived statement from Rothschild & Co website: “The 1980s gave birth to the international phenomenon of privatisation. Rothschild was involved from the beginning and developed a pioneering role which spread out to more than 30 countries worldwide.” (Rothschild, 2011)

Ferguson further added that the N. M. Rothschild group was “controlled by the family through another Swiss company—Rothschild Concordia AG—which has a majority (52.4 per cent) stake in Rothschilds Continuation Holdings AG. Closely linked to this structure is the Paris-Orléans holding company which controls 37 per cent of Rothschild & Cie Banque in Paris, around 40 per cent of Rothschild North America, 22 per cent of Rothschild Canada and 40 per cent of Rothschild Europe.” In addition to the affiliated companies listed above, there were also smaller subsidiaries, and thus “in 1997 there were offices in Argentina, Bermuda, Brazil, Canada, Chile, Colombia, Czech Republic, Indonesia, Isle of Man, Japan, Luxembourg, Malaysia, Malta, Mexico, New Zealand, Poland, Russia, South Africa and Zimbabwe.” (Ferguson, 1999)

Later, several prominent politicians arrived on the political stage with an experience from one of the Rothschild’s banks. To name just some of the alumni, French President Emmanuel Macron earned about €2.9m as an investment banker at Rothschild between 2008 and 2010, notably for his role in advising Nestlé on the acquisition of a Pfizer unit. (Chassany, 2017) Even though Sir Evelyn and Lady Lynn openly supported Hillary Clinton in the 2016 US Presidential Elections (Godwin, 2017), they had a rather interesting connection to Donald Trump’s Cabinet. The reason is Trump’s appointment of one of the most experienced former Rothschild employees in America, Wilbur Ross, as Secretary of Commerce. Though this might seem only a coincidence and far-fetched speculation, the fact is that between the 1970s and 1990s, Ross spent 25 years in Rothschild Inc, heading the bankruptcy division, and more importantly, it was Ross who provided massive loans which helped Trump keep his ownership of the Taj Mahal casino during the 1980s credit crisis. (Alexander, 2017)

When the French and British branches decided to merge its companies in 2003, a new family business flagship emerged – Rothschild & Co. The company’s website states the following: “We provide M&A, strategy and financing advice, as well as investment and wealth management solutions to large institutions, families, individuals and governments, worldwide.” It then quite openly defines the company’s position: “Having been at the centre of the world’s financial markets for over 200 years, we can rely on an unrivalled global network of trusted professionals and decision makers. This means that we have in-depth market intelligence, bringing us closer to current issues than any other global financial institution.” As of 2020, the firm had 3,600 employees in over 50 offices around the world, with three business lines: Global Advisory, Wealth and Asset Management, and Merchant Banking. (Rothschild & Co, 2020)

Gardas_ThesisA deeper look into the high end Rothschild network.

Further Study

China