Echoes of 1939

International Convergence of Capital Measurement and Capital Standards

A Revised Framework

June 2004

It would seem all so called banking commentators, financial experts and even those claiming to be the good guys busy exposing the naughtiness of the Federal Reserve in the US, have one thing in common… they each appear never to speak of the frameworks under which the entire global banking system has operated, launching two financial crashes and decimating the economies of all nations tied to its guidelines that enforce the legislation via incorporated governments.

The Bank for International Settlements began the current foundation framework under which all banks, dictated by each respective central bank, have operated, since 1988, followed by a series of amendments as the years moved on until the big one in 2007 sparked by Alan Greenspan. From their own website they quote one of their reports as follows :

Introduction

This report presents the outcome of the Basel Committee on Banking Supervision’s (the Committee)1 work over recent years to secure international convergence on revisions to supervisory regulations governing the capital adequacy of internationally active banks. Following the publication of the Committee’s first round of proposals for revising the capital adequacy framework in June 1999, an extensive consultative process was set in train in all member countries and the proposals were also circulated to supervisory authorities worldwide. The Committee subsequently released additional proposals for consultation in January 2001 and April 2003 and furthermore conducted three quantitative impact studies related to its proposals. As a result of these efforts, many valuable improvements have been made to the original proposals. The present paper is now a statement of the Committee agreed by all its members. It sets out the details of the agreed Framework for measuring capital adequacy and the minimum standard to be achieved which the national supervisory authorities represented on the Committee will propose for adoption in their respective countries. This Framework and the standard it contains have been endorsed by the Central Bank Governors and Heads of Banking Supervision of the Group of Ten countries.

Today we have bailout upon bailout with nations frantically lending big loans to failing nations to prop them up, as though we are in the days of the last century specifically 1939, to avoid war in Europe. Gold was moving about like crazy as through Wall Street, the Committee forced nations to favour the dollar for their portfolios. War was coming and the European nations under the direction of the Bank for International Settlements battled for financial survival while the money masters shifted money and gold to safe havens such as Switzerland, the US, and Borgos.

What was clear in those times was the fact what was achieved in 1930 when cap in hand the nations involved in WWI went to the fund produced by the super rich families from the East India Companies, Committee of 300, to gain credit to avoid financial collapse turning into financial catastrophe, was coming to a fruition point in 1939 before the outbreak of WWII. The framework then was all about stability, today as they play the same game against the nations of the world they use the term supervision, because they are now in the position to take control of all assets globally as the nations fall about themselves ignorant of the scam playing out all around them, monopoly.

If the banks have acted under guidelines from the BIS taking 1988 as our point of reference, then all that has ensued from that point is so because of the very guidelines the banking system has blindly followed.

Below is the document for today, the framework followed since 2004 leading to the 2007 calamity.

Below that is a collection of de-classified telegrams between the US State Department and various men in the field as Europe disintegrates into war in 1939 :

bcbs107

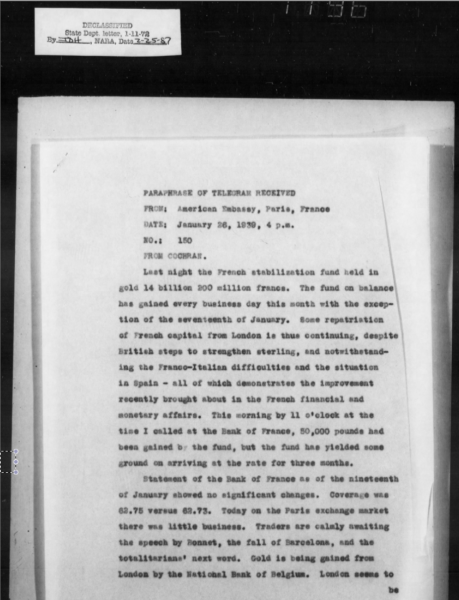

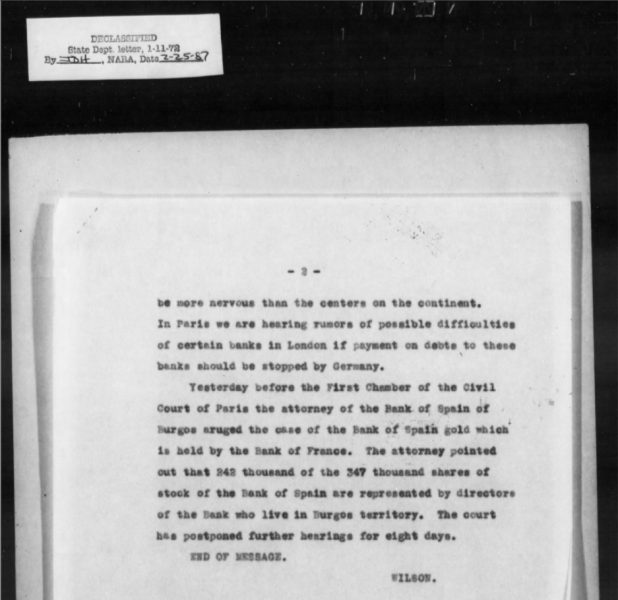

De-classified telegram 1939, Spanish central bank shareholders are in Borgos (click images to enlarge)

m

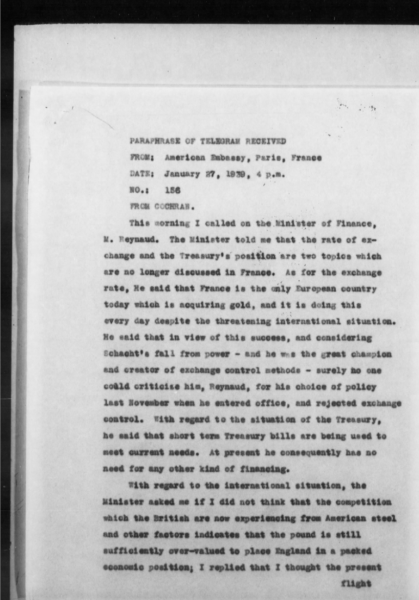

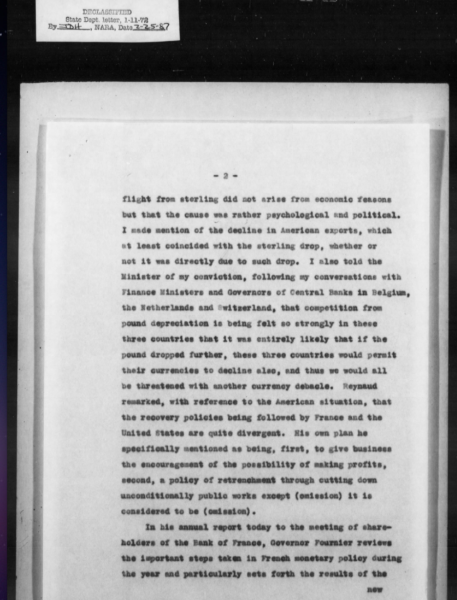

De-classified telegram1939 British-French loan to Czechs £12 million of which £10 million goes to the bank of England to pay a debt accrued in 1937 :

m

m

m

Further Study

The Basel Committee on Banking Supervision controlling global corporate governance

Basel Committee on Banking Supervision : dictating credit rating agency guidelines

In Profile : Basel III

G-SIFI-Bank of England Bail-in Mechanism

In Profile : Wilmington Trust Corporation

Blueprint For The New World Revolution, The Sprit Of Militarism